Thinking about Signing Up?

Join me and my 18 years of investing experience through the next frontier of investing. I tackle everything the market has to offer and sift through the value for you to extract out of the market. Let’s extract value out of this market together using fundamental and technical analysis to give us the edge.

Two Membership Levels

Platinum Membership

- Website/Finding Value personal stock portfolio

- Technical Charting of Individual Companies

- Discord Server Access

- Scheduled Zoom Meetings (Saturday 7AM or Sunday 5PM mountain time)

- Financial Education

- Ratio and Market Condition Updates

- All Access to Everything the Site has to Offer

What Does The Site Offer?

- The website allows you to have more confidence in investing by learning more about the three pillars of investing.

- Ratio Analysis

- Market Conditions

- Technical Analysis

- Careful use of the techniques described will enable users of this members only site to anticipate market moves, directional changes, turning points etc.

- Of course, predicting the future comes with no guarantees, but it’s all about stacking the odds in our favor, and helping to increase confidence levels.

- I am an analyst, not a financial advisor, so I do not tell anyone when to buy/sell particular stocks. The charts DO however contain support/resistance levels and I DO highlight important breakouts/breakdowns.

- Everybody has a different investment plan and trading style, as well as a different risk tolerance, so as an investor, our charts will help you to make much better informed trading and investing decisions for yourself.

- Here you will find regular, detailed charts across a variety of markets.

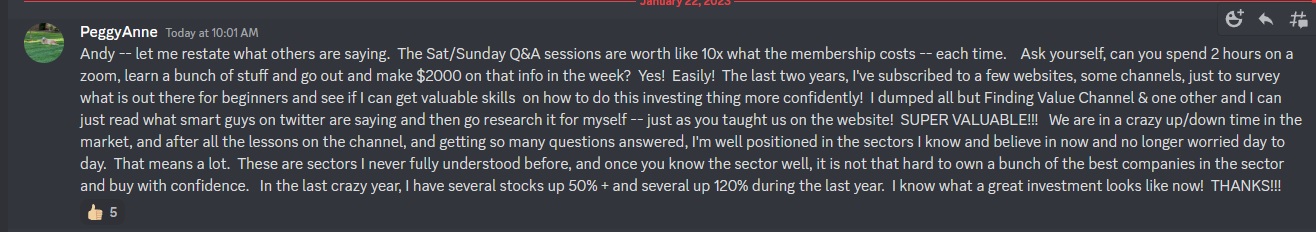

- I have weekly questions and answers sessions and sometimes training sessions for members. Look for those stickied at the top of the posts for platinum members. This provides extreme value for those who learn by asking questions and having conversations about ratios, market conditions and technical analysis.

About me and the three pillars of investing.

My name is Andy and my Youtube channel is Finding Value Finance. I created this website since I wanted to share what I have learned over the years investing in different asset classes. I apply a unique approach to investing which have three major pillars. These three major pillars to investing include ratios, market conditions, and technical analysis.

Ratios are assets priced against other assets and compared to over time. Ratios identify a couple of key aspects that every investor should be aware of. It identifies where money has flowed and how money is flowing based off historical ratios and how these ratios are fluctuating against each other over time. Investors need to incorporate ratio investing to ensure they are in undervalued assets and money is flowing into their investments. The ultimate reason to invest is to increase purchasing power. The only way to ensure you are increasing purchasing power is by being able to by more of other assets and ratios verify this purchasing power increase.

Market Conditions are what influences humans to move money from some assets to other assets. Market conditions are what drives money flows to happen over time changing the ratios and valuations of assets. A major market condition that I follow are new homes being built (housing starts) which impacts the money supply in our fractional reserve lending system since roughly 60% of loans made by commercial banks comes from residential real estate loans. New homes credit volumes is one of the largest drivers of the boom/bust cycle in the system which impacts interest rates. Interest rates in turn impacts how assets are priced and how money flows between investments.

Technical Analysis validates that the ratios and market conditions are changing favorably for investments. It can monitor the progress of ratio movements and market conditions. It can also identify potential investment opportunities based off known technical analysis patterns (human behavior) that occur in history and the size of the potential moves using fractals.

I tie these three pillars together to weave a story that everyone can understand and then tie my market knowledge to potential investment vehicles to take advantage of whatever market opportunities there are in the market. I look for the largest asymmetric opportunities to invest in across the entire market. These investments are good for the entire bull market and usually last for 5-10+ years. I do not do short term trading although some of the techniques could be applied to shorter timeframes.

Disclaimer: Everything I talk about on this website is only my financial opinion and should not be used as advice. I am simply sharing what I have learned over my years of investing to expedite your learning process as an investor yourself.

Hi Andy

I’m a small investor from New Zealand have been in a struggling business for 12years and after finding a love for commodities. I decided to sell up and invest the little equity iv emulated. I’m dyslexic and struggle to read documents, But I get there. I’d like to thank you for your videos’ they are excellent! Looking at joining the year platinum membership. I see there is a discount code how do I find that code as the membership will be close to $900 Nz. We’ll worth. But any saving is a saving. Have invested half my available funds. Looking for a good home for the other half. Keep up the excellent work.

Kind regards Craig McBeth

I only use the coupon code for the silver members who want to move to a platinum membership. I do not have any discount codes for those who are new members.

What is this discount code? Thanks.

https://schiffgold.com/exploring-finance/comex-inventory-why-is-registered-collapsing-during-backwardation/

Hi Andy, I’m interested in your membership but seem to be missing the tab that lets me sign up / see the pricing. Is it hidden somewhere?

https://finding-value.com/membership-account/membership-levels/

No worries thanks for the reply.

Hi I love your videos I’m just curious to know if by signing up to your silver or platinum levels do I get access to all your sectors that interest you at the time or just to commodities?

Thanks.

Joseph

Do you also monitor other sectors besides energy and commodities in your platinum membership? Also, will you switch your emphasis to different sectors as the current energy cycle matures years from now?

Yes, I will switch to different sectors as those sectors become favorable. That is why I specifically chose the name finding value. It allows me to switch to any sector that will be in favor and has value. Right now commodities and precious metals look great.

Your youtube video comparing housing starts vs the money supply/inflation was worth $50 by itself. I’m now a Platinum Subscriber. Thanks.

Am very interested in joining your platinum membership. I’ve been following you for a long time, and feel that good money can be made in these times, but only if you’re with somebody who can teach you how to invest, and will allow you to peak at their research, as you develop the skills.

You promise both.

Also, will you give evaluations on a platinum member’s portfolio?

Do you have testimonials from clients?

Andy, is there a better way of contacting you?

I cannot give advice on anything but I can answer what I am doing with my own portfolio and a lot of the posts talk about portfolio allocation and position sizing.

Hi Andy,

here is a german website that shows the platinum to gold ratio since 1880. Heard you are looking for this.

https://gold.bullionvault.de/gold-news/Platinpreis-im-Verhaeltnis-zu-Goldpreis-so-niedrig-wie-zuletzt-im-19-Jahrhundert-12042017

It shows that platinum was around 6x the price of gold during the Weimar Republic

That is awesome! Thanks for that. No one ever talks about platinum during that time period and they always mention gold outperforming silver, but no one talks about platinum waxing gold at that time.

Can’t find your pricing for the membership…can’t find the public availble Zoom meeting you talked about on the recent Youtube video….

Try to become a member and all the pricing is there.

Would love to know what the price difference was at the START of their hyperinflation?? was it almost the same price? or did Pt do 6xs better BECAUSE of hyperinflation?

Can I cancel a subscription at any time?

Yes you can cancel at any time. If you cancel you will lose access to the site immediately though.

Hello. I have been following you on YT since 2020, what an education you have provided us. Your down to earth approach is

helpful, as I distrust these polished suits you find otherwise. I tried to send you a donation a while back just for the education you have provided but was unable to do that. I just logged on here tonite to try to join up, but cant find the dm membership button? where is it on this page pls?

Thank you from an iron foundry worker in the Midwest

https://finding-value.com/membership-account/membership-levels/

Hi

I’m looking at taking out a membership, could you please give me an outline of what the Silver Membership’s ” Finding Value Donation Portfolio”

is.

Thanks.

I think platinum membership offers a lot more value than the silver membership. If you want more face time and questions and answers sessions and technical training it is all offered in the platinum membership. Silver covers only the basics but is more financial education driven. You will get more and quicker in the platinum membership for becoming a better investor.

Hey Andy,

love your approach and would really like to join as a Platin member. It seems that my Credit card ist not compatible tho (some german Bank but a Visa card).

Is there any possibility to setup an account with an alternative Option? (e.g. I can do Bank Transfer, Wire, Paypal).

Hope we can find a way there.

Best

Please use the contact me page so we can email about this.

I got the same problem.

Hi Andy

New member here, will you be sharing any new buy signals?

Current portfolio

Encore Energy

Energy Fuels

Uranium Energy Corp

Cameco

Elevate Uranium

Sigma Lithium Corp

Syrah Resources

Eco Atlantic Oil and Gas

Any thoughts? Thanks. Stephen

Yea, a lot of really solid companies there for speculation. solid uranium picks.

Hi Andy. Active listener here. Although I realize it is merely a blind guess, what % chance would you give Cameco, URNM, etc. to retrace and fill that uranium equities gap from Aug. 24? It would entail a significant pullback of 20+%, but many say that gaps do get filled the majority of time. Cameco historically has one final dip in the second half of Sept. before rocketing up the rest of the year. Whether it fills this gap or not, I see Q4 of 2022 as being unbelievably bullish for the uranium sector.

Thanks!

Ken

San Antonio, TX

It is possible that the gap gets filled, but I don’t prescribe that all gaps get filled.

Can I get a discount code for my sign up?

I only use the discount code for people who are moving from silver to platinum memberships.

Hi Andy

What is your thoughts on the graphite market? I think it is one of the next places where we see a structural deficit. I remember you touched it briefly in a previous clip on YouTube.

Yes, I think we are seeing positive signs in a lot of the graphite companies breaking long term downtrends. I think they look great.

I am seeing some of the same patterns. Will you be doing a video on YT on graphite and TA on some of the companies?

In your portfolio you have a stock and it says consolidating into…. Does that mean you have given up on that stock and sold it to put the money into the consolidated name? I don’t understand.

I sold the stock and purchased the one I am consolidating into it.

so sold the OG stock.

Hi Andy

What is your take on Gratomic?

Hi Andy

What is your opinion on Gratomic?

Can you list the difference between the Silver and Plat memberships?

Platinum membership gives you full access to the website and the only one I recommend. Silver is only for education information. I give all the updates and everything to only the platinum members in terms of companies I like.

Anyone else having problem starting subscription? I am from sweden and i doesnt work to pay with my credit cards?

Please message me.

https://finding-value.com/contact/

I have got the same problem. I sent a message to you, two days ago 🙂

Please provide info to obtain a Platinum Membership.

Thank you.

Look what you did to $FRO , I bought right after you highlighted it lol.

Up over 15% now

Thank you.

I was going to sign up but I can’t find the way to PAY and get in. WTF ?? Maybe you should have a button to take to the way to pay for a membership ?? What do you think ?? I’ve tried every button. The learn more button works but no sign up. … Very impressive !!

Thanks

Would like to join platium membership?

Emailed you.

Hi Andy. I’m, absolutely, loving your videos lately.. out of curiosity, how much is the platinum membership?

With the coupon code “discount” you get $10 off the first month of monthly membership and it is $50/month. The yearly has a discount of $50 off for the year.

It’s oct 31. Trying to join for yearly membership using spooky discount but says expired nov 1

Kindly advise

Andy not a member yet. Do you take a look at stocks for members and provide technical analysis of how they look to you during your questions and answer sessions? I am in Canada and am wondering do you look at the oil and gas sector here as well? I own a lot of stocks Eric Nuttall recommends.

I watch your Youtube video’s daily and appreciate your honest evaluation of the markets and commodity sectors.

Yes I look at companies from a technical analysis perspective and I know a lot of Eric’s favorite picks and some of his picks overlays with mine in Canada.

One thing I find Andy is trying not to get emotional when a sector takes off! The fear greed factor. I tend to want to get in when the price is more expensive. I do like how you use ratio’s and other technical analysis to help you get a good value entry point.

Come to the training and I can show you how I enter positions and give a few recent examples.

I too can’t find price between both levels.

Please E-mail me as well.

Emailed you with pricing.

Tell me how to sign up. I go to your site. It says “Thinking about signing up?” But no where to sign up. Info on 3 pillars, etc. Etc. Special code “holliday” But no place to sign up.. please tell me how much $ for one year and how I can join. I’m at dtchambers2@gmail.com.

emailed you.

I am having trouble finding out difference between 2 levels of membership. why doesnt it show on site and how much? do you have an introductory offer? I saw you on capitalcosm with badcharts people. I am on their site after Justin Huhn said it was good but they do NO fundamental analysis which is necessary for uran ium. Have watched your videos before. thinking of trying. thanks.

Check your email.

Hello Andy,

Please send me the info for your membership

fee structure for the monthly & yearly timelines

I’m very interested.

Thank You

Hey Andy,

I’m from Japan & new to EVERYthing. I just want to understand what is happening & learn how u guys analyze..i paid for some online lessons from so SO MANY places but I found that could not teach me well enough or I COULD NOT learn …my brain wonders off sometimes…& i am so WORRIED about the RESET/inflation/4th turning. When d C19 made us stay home i began research ON UTUBE… & found out that I kinda like economics more than war except that i do not even know what kind of economics i like macro? Micro? I want to find out & when u started talking, u touched on stuff that i found interesting..i took udemy courses on stock markets how to read companies for investment…but i still do not understand AFTER investing in Japanese stock market (LOST BIG Time) on jap stocks like 1542,8604,4344. Tell u the truth, i do not think i want to place my $ in stocks till i am SURE i know how to read the market..and i was wondering if u could teach me…i hope it wont be so expensive coz i lost a lot of money in 2020 & now they say usa/jap markets will not be going anywhere for a while…maybe its time to learn?

Sincerely,

Regina Long

I’m interested in the monthly Andy just to check it out, email me

Hi Andy, I’m interested in your content. Can you please email me the pricing for the membership levels. Thank you.