Thinking about Signing Up?

Join me and my 18 years of investing experience through the next frontier of investing. I tackle everything the market has to offer and sift through the value for you to extract out of the market. Let’s extract value out of this market together using fundamental and technical analysis to give us the edge.

Platinum Membership ONLY

- Website/Finding Value personal stock portfolio

- Technical Charting of Individual Companies

- Discord Server Access

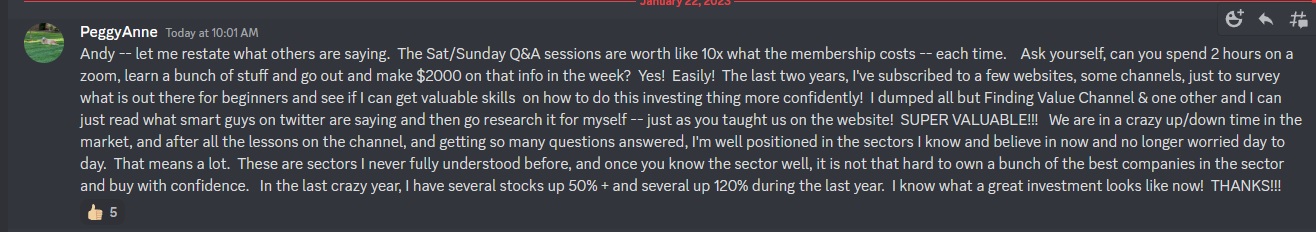

- Scheduled Zoom Meetings (Saturday 7AM or Sunday 5PM mountain time)

- Financial Education

- Ratio and Market Condition Updates

- All Access to Everything the Site has to Offer

What Does The Site Offer?

- The website allows you to have more confidence in investing by learning more about the three pillars of investing.

- Ratio Analysis

- Market Conditions

- Technical Analysis

- Careful use of the techniques described will enable users of this members only site to anticipate market moves, directional changes, turning points etc.

- Of course, predicting the future comes with no guarantees, but it’s all about stacking the odds in our favor, and helping to increase confidence levels.

- I am an analyst, not a financial advisor, so I do not tell anyone when to buy/sell particular stocks. The charts DO however contain support/resistance levels and I DO highlight important breakouts/breakdowns.

- Everybody has a different investment plan and trading style, as well as a different risk tolerance, so as an investor, our charts will help you to make much better informed trading and investing decisions for yourself.

- Here you will find regular, detailed charts across a variety of markets.

- I have weekly questions and answers sessions and sometimes training sessions for members. Look for those stickied at the top of the posts for platinum members. This provides extreme value for those who learn by asking questions and having conversations about ratios, market conditions and technical analysis.

About me and the three pillars of investing.

My name is Andy and my Youtube channel is Finding Value Finance. I created this website since I wanted to share what I have learned over the years investing in different asset classes. I apply a unique approach to investing which have three major pillars. These three major pillars to investing include ratios, market conditions, and technical analysis.

Ratios are assets priced against other assets and compared to over time. Ratios identify a couple of key aspects that every investor should be aware of. It identifies where money has flowed and how money is flowing based off historical ratios and how these ratios are fluctuating against each other over time. Investors need to incorporate ratio investing to ensure they are in undervalued assets and money is flowing into their investments. The ultimate reason to invest is to increase purchasing power. The only way to ensure you are increasing purchasing power is by being able to by more of other assets and ratios verify this purchasing power increase.

Market Conditions are what influences humans to move money from some assets to other assets. Market conditions are what drives money flows to happen over time changing the ratios and valuations of assets. A major market condition that I follow are new homes being built (housing starts) which impacts the money supply in our fractional reserve lending system since roughly 60% of loans made by commercial banks comes from residential real estate loans. New homes credit volumes is one of the largest drivers of the boom/bust cycle in the system which impacts interest rates. Interest rates in turn impacts how assets are priced and how money flows between investments.

Technical Analysis validates that the ratios and market conditions are changing favorably for investments. It can monitor the progress of ratio movements and market conditions. It can also identify potential investment opportunities based off known technical analysis patterns (human behavior) that occur in history and the size of the potential moves using fractals.

I tie these three pillars together to weave a story that everyone can understand and then tie my market knowledge to potential investment vehicles to take advantage of whatever market opportunities there are in the market. I look for the largest asymmetric opportunities to invest in across the entire market. These investments are good for the entire bull market and usually last for 5-10+ years. I do not do short term trading although some of the techniques could be applied to shorter timeframes.

Disclaimer: Everything I talk about on this website is only my financial opinion and should not be used as advice. I am simply sharing what I have learned over my years of investing to expedite your learning process as an investor yourself.